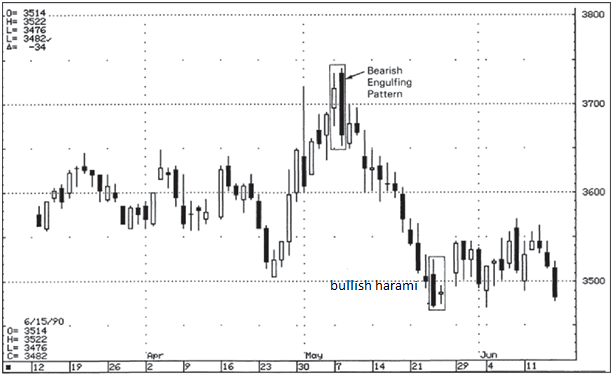

Bullish Harami

A candlestick chart pattern in which a large candlestick is followed by a smaller candlestick whose body is located within the vertical range of the larger body. In downtrends, the harami consists of a large black candle followed by a small white or black candle (usually white) that is within the previous session’s large real body. This pattern signifies that the immediately preceding trend may be concluding, and that the bulls and bears have called a truce.

Description

The Harami is a commonly observed phenomenon. The pattern is composed of a two candle formation in a down-trending market. The color first candle is the same as that of current trend. The first body in the pattern is longer than the second one. The open and the close occur inside the open and the close of the previous day. Its presence indicates that the trend is over.

The Harami (meaning “pregnant” in Japanese) Candlestick Pattern is a reversal pattern. The pattern consists of two Candlesticks. The first candle is black in color and a continuation of

the existing trend. The second candle, the little belly sticking out, is usually white in color but that is not always the case. Magnitude of the reversal is affected by the location and size of the candles.

Criteria

- The first candle is black in body; the body of the second candle is

- The downtrend has been evident for a good A long black candle occurs at the end of the trend.

- The second day opens higher than the close of the previous day and closes lower than the open of the prior

- Unlike the Western “Inside Day”, just the body needs to remain in the previous day’s body, where as the “Inside Day” requires both the body and the shadows to remain inside the previous day’s

- For a reversal signal, further confirmation is required to indicate that the trend is now moving

Signal enhancements

- The reversal will be more forceful if the black candle and the white candle are

- If the white candle closes up on the black candle then the reversal has occurred in a convincing manner despite the size of the white

Pattern psychology

After a strong down-trend has been in effect and after a selling day, the bulls open at a price higher than the previous close. The short’s get concerned and start covering. The price for the day finishes at a higher level. This gives enough notice to the short sellers that trend has been violated. A strong day i.e. the next day would convince everybody that the trend was reversing. Usually the volume is above the recent norm due to the unwinding of short positions.

When the second candle is a doji, which is a candle with an almost non-existent real body, these patterns are called “harami crosses.” They are however less reliable as reversal patterns as more indecision is indicated.